Using Life Insurance to Insure Legal Obligations in Divorce

Unfortunately these days, marriage doesn’t usually last forever. In fact slightly over half of all marriages end up in divorce. And once a couple decided to go down the road of divorce, there are numerous issues that need to be resolved from who gets custody, home, finances, cars, etc. In some cases, the list can go on and on. But no matter how much wealth and miscellaneous items a couple has, it is usually always the kids that come first. And many divorce settlements will force one of the parents (usually the one without full custody) to get some type of life insurance. Check out some of the finer details from our friends at DBS (Diversified Brokerage Services) on the subject.

Unfortunately these days, marriage doesn’t usually last forever. In fact slightly over half of all marriages end up in divorce. And once a couple decided to go down the road of divorce, there are numerous issues that need to be resolved from who gets custody, home, finances, cars, etc. In some cases, the list can go on and on. But no matter how much wealth and miscellaneous items a couple has, it is usually always the kids that come first. And many divorce settlements will force one of the parents (usually the one without full custody) to get some type of life insurance. Check out some of the finer details from our friends at DBS (Diversified Brokerage Services) on the subject.

Many divorce decrees require that the non-custodial parent maintains life insurance for the benefit of the custodial parent and/or the children for a specified period of time. The question then turns to who should own the policy and what type of product should be purchased.

Policy ownership is usually very emotionally charged. Ownership by the insured/non-custodial spouse will raise concerns from the custodial spouse about monitoring premium payments and assuring that beneficiary designations are maintained, while ownership by the custodial spouse may raise concerns regarding the insured’s desire to retain control for conversion and insurability protection if needed in the future as circumstances change (such as remarriage).

Once the ownership decision is made, the question then turns to what type of insurance should be purchased. Often term insurance is purchased because only a short-term period of coverage is desired. However, even when the type of coverage is narrowed to term insurance, there are a variety of term options to consider.

Where the insured/non-custodial parent will be the policy owner, if you would like to offer the client the opportunity to fulfill this life insurance support obligation and get a full refund of premiums paid – subject to carrier specific conditions – consider Return of Premium Term. Alternatively, where the insured/non-custodial parent has a need to provide coverage for multiple needs with varying lengths of time you can now offer term insurance coverage that provides flexible term periods and a term rider that can be used to customize protection.

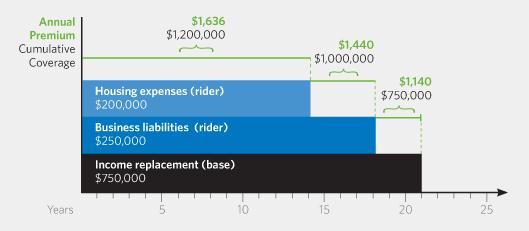

For example, with one insurance carrier it’s possible to customize up to twenty-one (21) different term periods so there is no need to pay for coverage not needed. And, the term rider offers up to five (5) layers of coverage protection to meet specific short-term needs such as child support, college education, and debt/mortgage liquidation as depicted in the following graph.

August 2, 2012

August 2, 2012

No comments yet... Be the first to leave a reply!