What types of Term Life Insurance is available today?

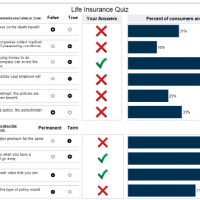

Understanding Term Life Insurance When you’re considering term life insurance, you need to understand the different types of term life available today. Term life is the least expensive insurance available today and if used correctly could be the best insurance for you. In fact many people supplement permanent life insurance (universal, indexed universal or whole [...]

Read more

February 14, 2013

February 14, 2013

Recent Comments